Property Tax Rate In Arlington Va . how taxes are calculated. today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). learn how property taxes in arlington, va, are calculated and used. per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. The treasurer collects real estate taxes. Discover programs to lower your taxes and how to appeal an. Each year, the department of real estate assessments determines the value of real property in. residential property values increased 3.2%. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value.

from taxblog.billrubin.info

arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. how taxes are calculated. The treasurer collects real estate taxes. residential property values increased 3.2%. learn how property taxes in arlington, va, are calculated and used. Each year, the department of real estate assessments determines the value of real property in. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. Discover programs to lower your taxes and how to appeal an.

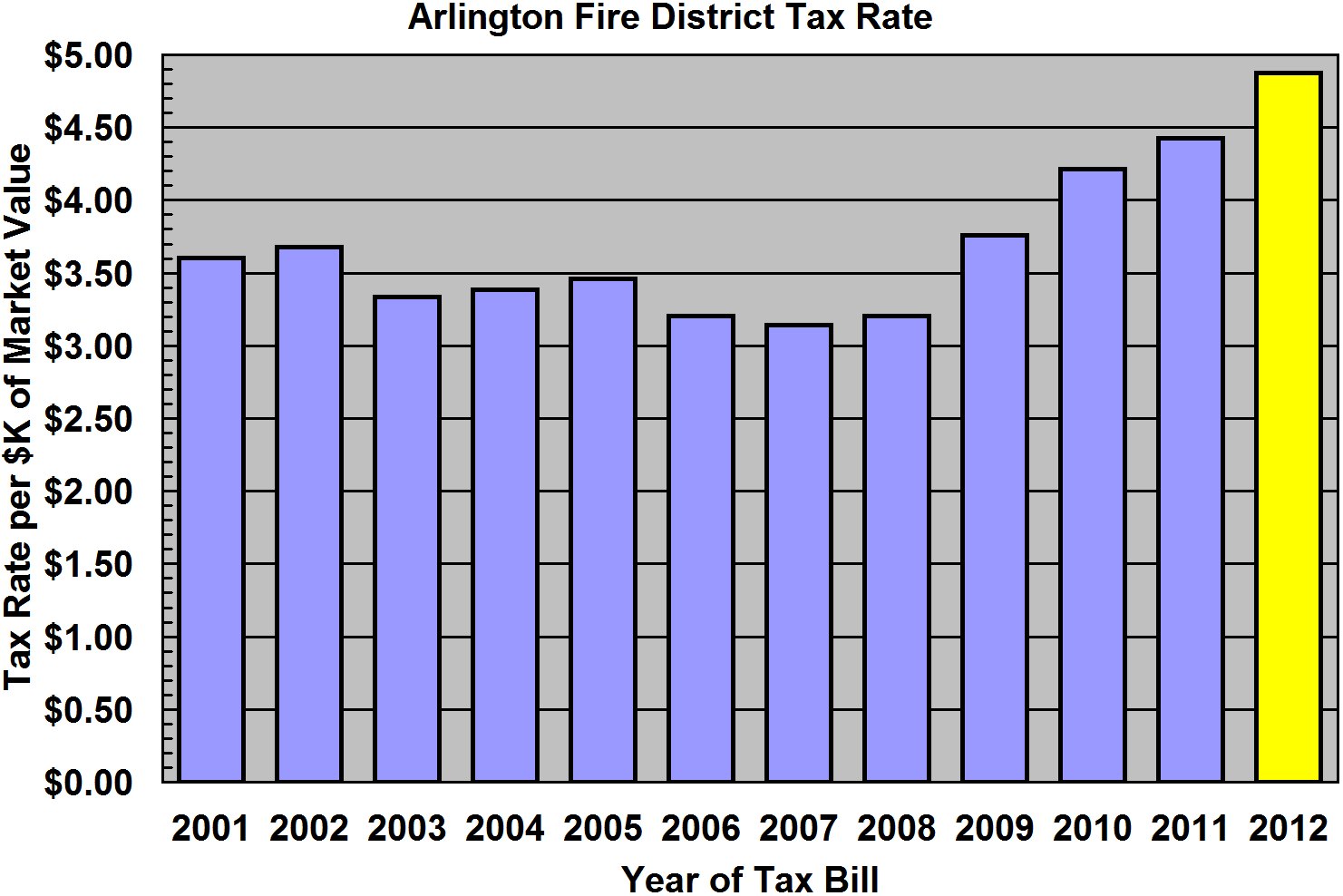

Property Tax in Dutchess County Arlington Fire District Proposes 10.1

Property Tax Rate In Arlington Va residential property values increased 3.2%. Each year, the department of real estate assessments determines the value of real property in. The treasurer collects real estate taxes. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. residential property values increased 3.2%. how taxes are calculated. Discover programs to lower your taxes and how to appeal an. today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). learn how property taxes in arlington, va, are calculated and used. per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment.

From hxeupsrnl.blob.core.windows.net

Arlington Virginia Tax Rate at Kelvin Jones blog Property Tax Rate In Arlington Va arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. how taxes are calculated. learn how property taxes in arlington, va, are calculated and used. Discover programs. Property Tax Rate In Arlington Va.

From www.arlnow.com

Arlington County Board Approves New Budget That Holds Property Tax Rate Property Tax Rate In Arlington Va learn how property taxes in arlington, va, are calculated and used. Discover programs to lower your taxes and how to appeal an. Each year, the department of real estate assessments determines the value of real property in. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). how taxes are calculated.. Property Tax Rate In Arlington Va.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Property Tax Rate In Arlington Va per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. Discover. Property Tax Rate In Arlington Va.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate In Arlington Va learn how property taxes in arlington, va, are calculated and used. how taxes are calculated. Discover programs to lower your taxes and how to appeal an. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. today, the arlington county board voted to. Property Tax Rate In Arlington Va.

From stephenhaw.com

Rates of Property Taxes in California's The Stephen Haw Group Property Tax Rate In Arlington Va per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. learn how property taxes in arlington, va, are calculated and used. Each year, the department of real estate assessments determines the value of real property in. arlington county (0.89%) has a 17.1% higher property tax rate than the average of. Property Tax Rate In Arlington Va.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Property Tax Rate In Arlington Va how taxes are calculated. Discover programs to lower your taxes and how to appeal an. Each year, the department of real estate assessments determines the value of real property in. residential property values increased 3.2%. The treasurer collects real estate taxes. today, the arlington county board voted to advertise a real estate tax rate of $1.038 per. Property Tax Rate In Arlington Va.

From www.yourathometeam.com

New Property Tax Rates Northern Virginia Property Tax Rate In Arlington Va Each year, the department of real estate assessments determines the value of real property in. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. today, the arlington county board voted to advertise a. Property Tax Rate In Arlington Va.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate In Arlington Va today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. how taxes are calculated. Discover programs to lower your taxes and how to appeal an. Each year, the department of real estate assessments determines the value of real property in. The treasurer collects real estate taxes. residential. Property Tax Rate In Arlington Va.

From www.star-telegram.com

Arlington City Council passes budget, property tax rates Fort Worth Property Tax Rate In Arlington Va The treasurer collects real estate taxes. today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. per the code of virginia, taxpayers are responsible. Property Tax Rate In Arlington Va.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate In Arlington Va the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. learn how property taxes in arlington, va, are calculated and used. The treasurer collects real estate taxes. Discover programs to lower your taxes and how to appeal an. per the code of virginia, taxpayers. Property Tax Rate In Arlington Va.

From studyimbalzano50.z21.web.core.windows.net

Virginia Estimated Tax Payments 2023 Rate Property Tax Rate In Arlington Va today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. Discover programs to lower your taxes and how to appeal an. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. Each year, the department. Property Tax Rate In Arlington Va.

From realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property Property Tax Rate In Arlington Va The treasurer collects real estate taxes. today, the arlington county board voted to advertise a real estate tax rate of $1.038 per $100 of assessed value,. per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. residential property values increased 3.2%. Discover programs to lower your taxes and how to. Property Tax Rate In Arlington Va.

From www.arlnow.com

Manager’s Proposed Budget to Include 3.2 Cent Tax Hike Property Tax Rate In Arlington Va per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. Discover programs to lower your taxes and how to appeal an. residential property values increased 3.2%. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. . Property Tax Rate In Arlington Va.

From hxeupsrnl.blob.core.windows.net

Arlington Virginia Tax Rate at Kelvin Jones blog Property Tax Rate In Arlington Va Discover programs to lower your taxes and how to appeal an. residential property values increased 3.2%. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). today,. Property Tax Rate In Arlington Va.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Arlington Va learn how property taxes in arlington, va, are calculated and used. arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. Discover programs to lower your taxes and. Property Tax Rate In Arlington Va.

From wallethub.com

Property Taxes by State Property Tax Rate In Arlington Va arlington county (0.89%) has a 17.1% higher property tax rate than the average of virginia (0.76%). Each year, the department of real estate assessments determines the value of real property in. per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. The treasurer collects real estate taxes. learn how property. Property Tax Rate In Arlington Va.

From www.nvar.com

Property Tax Rates Property Tax Rate In Arlington Va per the code of virginia, taxpayers are responsible for knowing the due dates and ensuring timely payment. Each year, the department of real estate assessments determines the value of real property in. how taxes are calculated. residential property values increased 3.2%. today, the arlington county board voted to advertise a real estate tax rate of $1.038. Property Tax Rate In Arlington Va.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate In Arlington Va residential property values increased 3.2%. learn how property taxes in arlington, va, are calculated and used. The treasurer collects real estate taxes. the median property tax (also known as real estate tax) in arlington county is $4,564.00 per year, based on a median home value. how taxes are calculated. per the code of virginia, taxpayers. Property Tax Rate In Arlington Va.